Digital Banking FAQ

The Credit Human Member Service Center is available to help you Monday-Friday 7 am to 7 pm and Saturday 9 am to 12 pm CT. Just call toll free at 800-688-7228. If you need after hours help, check below for answers to frequently asked questions. To find a Credit Human location or ATM, try our online locator.

Digital Banking FAQ

Digital Banking

All you need to get started with digital banking is an active Credit Human account, your last name, social security number, date of birth and account number. Register today.

To reset, click "Forgot your username or password?" and follow the prompts.

Yes, it is available for devices with Face ID capabilities. You must have the latest version of the mobile app installed.

All transactions, except for recurring payments, will be denied until you unlock your card.

If you have been locked out of your account contact Credit Human Member Service Center and request to have your account unlocked.

Visit our video tutorial page for instruction on how to use our digital banking platform to make a payment.

Bill Center

Bill Center is a convenient way to pay your bills from one secure place. You decide whom, when, and how often to pay. Schedule one-time or recurring payments from your Credit Human checking or money market account.

Estimated delivery date is within seven business days and will display when you schedule your payment.

Mobile Check Deposit

Mobile deposit is a fast, easy and secure way to deposit one or multiple checks from your smartphone or tablet with the Credit Human mobile app. Use the camera on your device to snap a picture of the front and back of the check, choose your account and submit.

If you're a member, you already have access to mobile deposit. This feature lets you deposit checks quickly and securely from your mobile device, giving you more flexibility in depositing your funds.

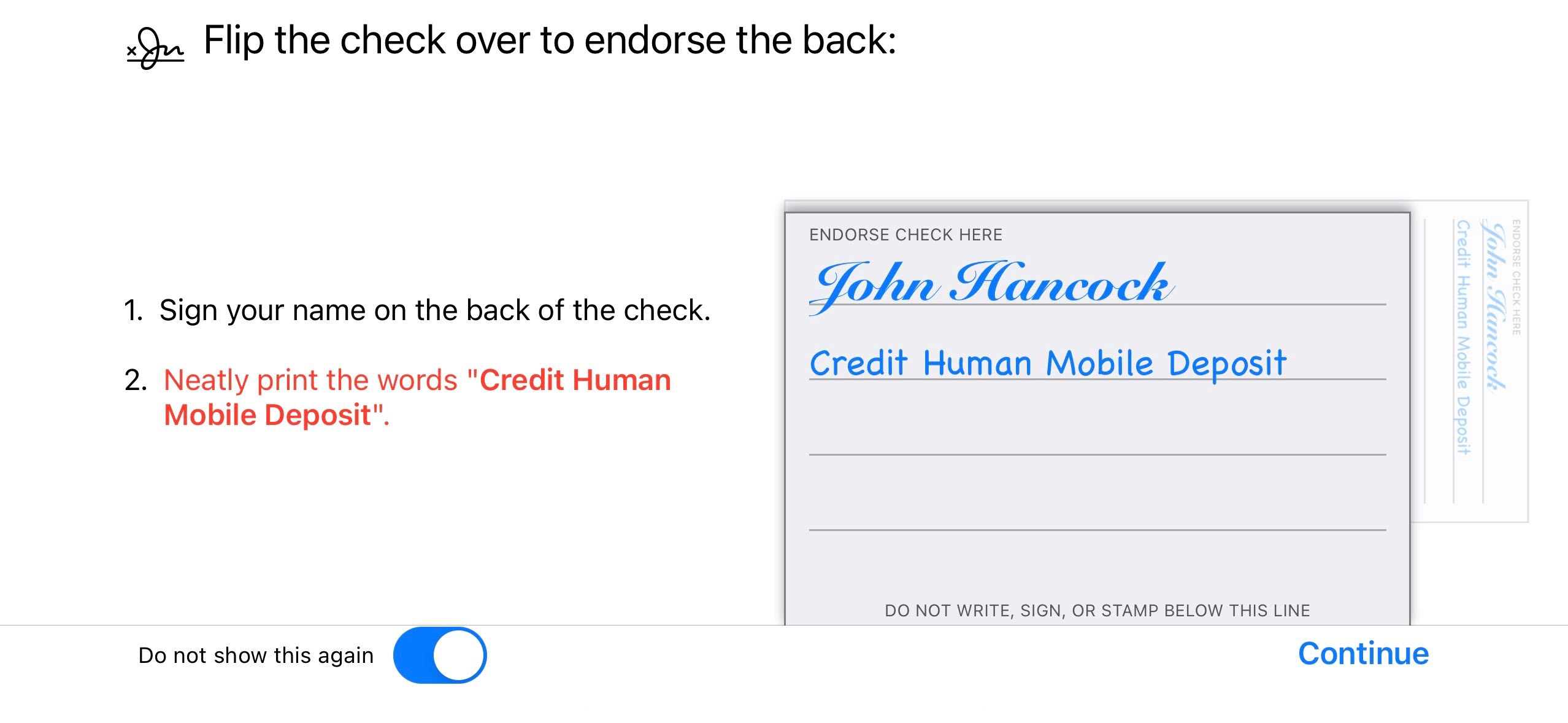

When depositing a check using the Credit Human Mobile app, make sure to sign the back of the check and use the endorsement below: Credit Human Mobile Deposit

.jpg)

A restrictive endorsement is a type of endorsement on the back of your check that helps ensure your check gets deposited to your account. Your signature and “Credit Human Mobile Deposit” is required on all checks deposited through our mobile app.

If you deposit a check without this endorsement, the check will be rejected due to the absence of a restrictive endorsement. You will receive an email notification stating the deposit was rejected due to the absence of a restrictive endorsement.

You can deposit business, personal and government checks that are issued from financial institutions in the United States.

With mobile deposits, there may be limits associated with how much you can deposit at once. These limits may differ from member to member depending on factors like:

Your mobile deposit limits can be found in the Credit Human mobile app.

- Your account type

- Your deposit history

- How long your account has been open

Your mobile deposit limits can be found in the Credit Human mobile app.