Spend

Spending is an essential function of our everyday lives. We know that spending less than your income is how we build financial slack. We’re here to support you as you look at your spending so you can reduce your financial stress.

There are many factors that help us determine how we spend our money. Making thoughtful decisions about our spending will better our chances at reaching our financial goals. There are two things that we should focus on when thinking about spending – paying bills on time and spending less than we earn.

Paying Bills

Paying bills on time is an important factor in determining your financial health. You should regularly take inventory of what bills you have and see if there are any you can eliminate or reduce. Another strategy is to see if you can change due dates to align with when your income comes in. Including this in a spending plan will keep you on track and help you reach financial goals.We’re here for you with resources to support you while you spend.

Financial Health Center

Free Checking

Spending Plan Worksheet

Financial Health Tools

Bill Center

Financial Health Snapshot

Article: Rework Bills & Manage Debt

Having a hard time making ends meet? We can help.

Article: Creating a Spending Plan

Learn some extra tips on how to create a spending plan

Article: GreenPath

We can help connect you with our partners who are experienced in financial counseling.Additional Resources

Knowledge and skills you can use to help you create and maintain financial slack

Spend less than Income

The main way to create financial slack is to spend less than you earn. The first step is taking a look at how much you spend. Then you can compare this to how much you earn. In order to create financial slack and ensure you are spending less than you earn you should ask yourself if there is a way you can earn more, ways you can spend less or both. Doing a spending plan is a great way to get started.

We’re here for you with resources to support you while you spend.

Financial Health Center

Free Checking

Spending Plan Worksheet

Dividend Checking

Spending Analysis

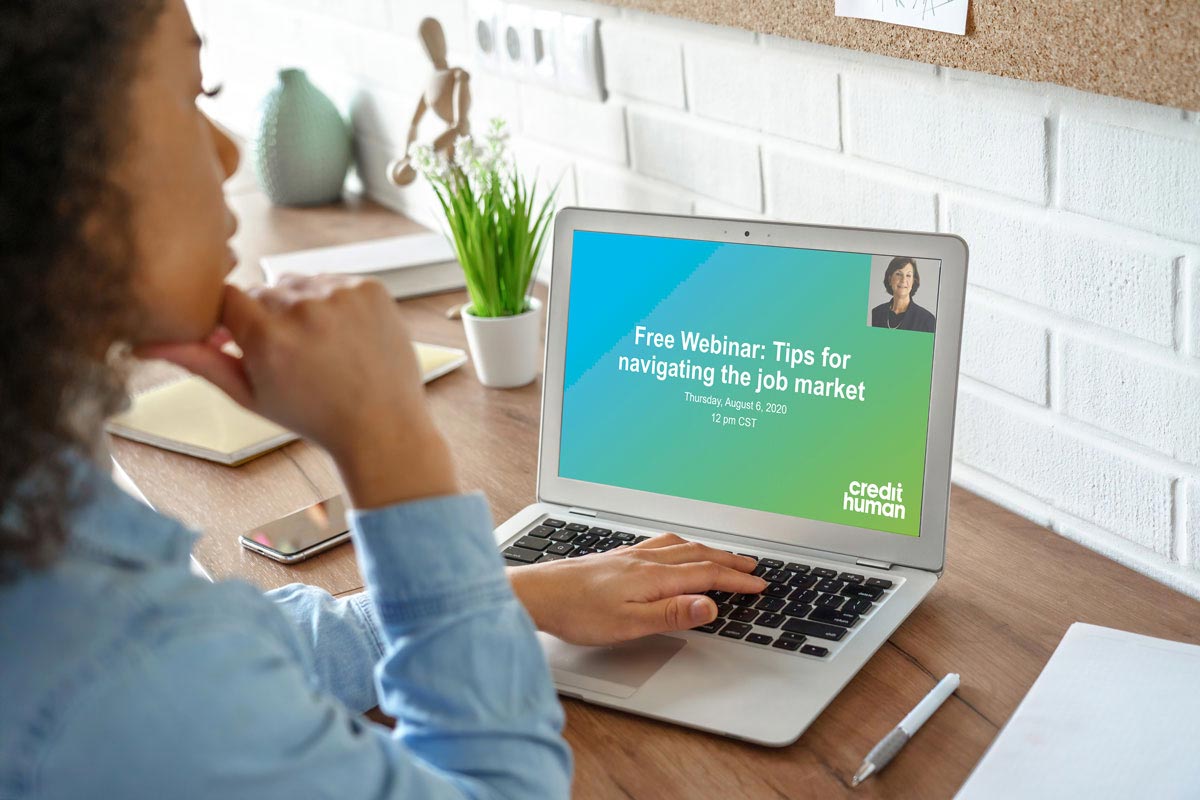

Webinar: Tips for Navigating the Job Market

Credit Human is here to help our community during these challenging times with free webinars.

Article: GreenPath

We can help connect you with our partners who are experienced in financial counseling.Additional Resources

Knowledge and skills you can use to help you create and maintain financial slackSaving isn’t the only thing to consider when thinking about your financial slack. Explore more in the areas of plan, save and borrow below.

Tools for Spending

Knowledge and skills you can use to help you create and maintain financial slack.

Learn MoreBuilding Slack

Credit Human is committed to helping our community by providing resources for less financial stress.

Learn More