Home Equity

Take advantage of your home's value to affordably cover a variety of expenses like home remodeling, education or medical costs. Our home equity loans can help take the stress out of borrowing with a low fixed rate, low monthly payments and potential tax advantages.

Ready to talk? Contact us at 844-468-9369 Monday through Friday 8:30 am to 5:30 pm CT.

Benefit from

- Low, fixed interest rates

- Terms up to 20 years

- Large borrowing potential

- Convenient online application

- Available in Texas, Louisiana, Colorado, and North Carolina

Apply Now

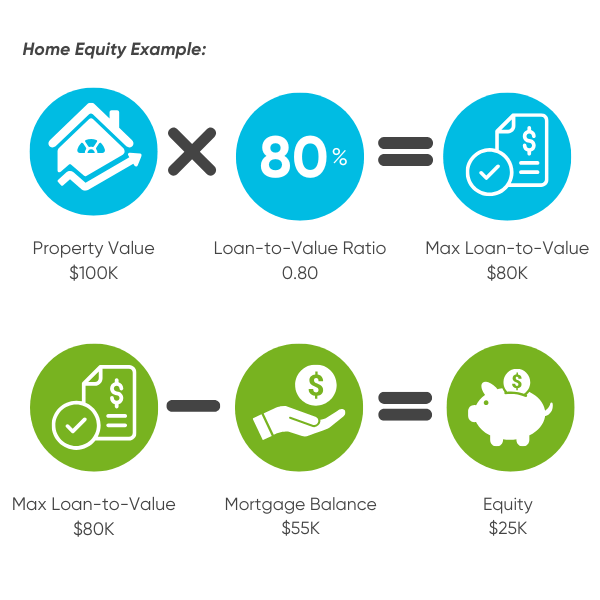

Understanding Your Home’s Equity

The equity in your home is the value of your home less any outstanding loans owed against it. A home equity loan allows you to borrow up to 80% of the value of your home.

Home Equity Example

If your home is valued at $100,000 you may borrow up to 80% of its value or $80,000. If you already have a home loan of $55,000 you would have $25,000 in equity that you may be able to borrow ($80,000 - $55,000 = $25,000).

Home equity rates

| Term | Rates as low as | APR as low as | Minimum Loan Amount | Maximum Loan Amount |

|---|---|---|---|---|

| Up to 15 years | 6.650% | 6.815% | $15,000 | $350,000 |

| 20 years | 6.725% | 6.857% | $15,000 | $350,000 |

| Term | Rates as low as | APR as low as | Minimum Loan Amount | Maximum Loan Amount |

|---|---|---|---|---|

| Up to 15 years | 7.550% | 7.719% | $15,000 | $250,000 |

Rates are effective as of February 11, 2026

Credit Human lending areas include the states of Colorado, Louisiana, North Carolina and Texas. Rates are subject to change without notice. Rates may be locked only after your completed loan application is received. This information is not a commitment to make a loan, nor is it a guarantee that you will receive a specific rate if approved. An annual percentage rate (APR) is a broader measure of the cost to you of borrowing money. The APR reflects not only the interest rate but also the points, mortgage fees, and other charges that you have to pay to get the loan.

Disclosed rates are based on a $175,000 loan amount, FICO of 740+ with a maximum loan-to-value of 80%.

Please contact a Credit Human Loan Advisor at 844-468-9369 for assistance if you have questions about rates and terms.