Accounts and Loans

The Credit Human Member Service Center is available to help you Monday-Friday 7 am to 7 pm and Saturday 9 am to 12 pm CT. Just call toll free at 800-688-7228. If you need after hours help, check below for answers to frequently asked questions. To find a Credit Human location or ATM, try our online locator.

Accounts and Loans

Checking Accounts

We offer a quick and simple online ordering by calling our Member Service Center toll free at 800-688-7228. It's as simple as ordering them in person or over the phone. You can also order checks online at your convenience or call Harland Clarke toll-free at 800-275-1053 24 hours a day, 7 days a week.

We offer easy to understand checking account options tailored to the needs of our members. There is a free checking account that comes without monthly fees and has no minimum balance requirement. Our dividend checking account earns dividends on your balance. Please explore our Checking & Savings to see all of the options, or talk to our Member Service Center toll free at 800-688-7228.

Credit Human provides a number convenient options. Learn more about your overdraft protection options.

Check our full funds availability policy (PDF) for details.

Items may be held against your balance for a number of reasons. Learn more about pending items and the difference between your current balance and your available balance.

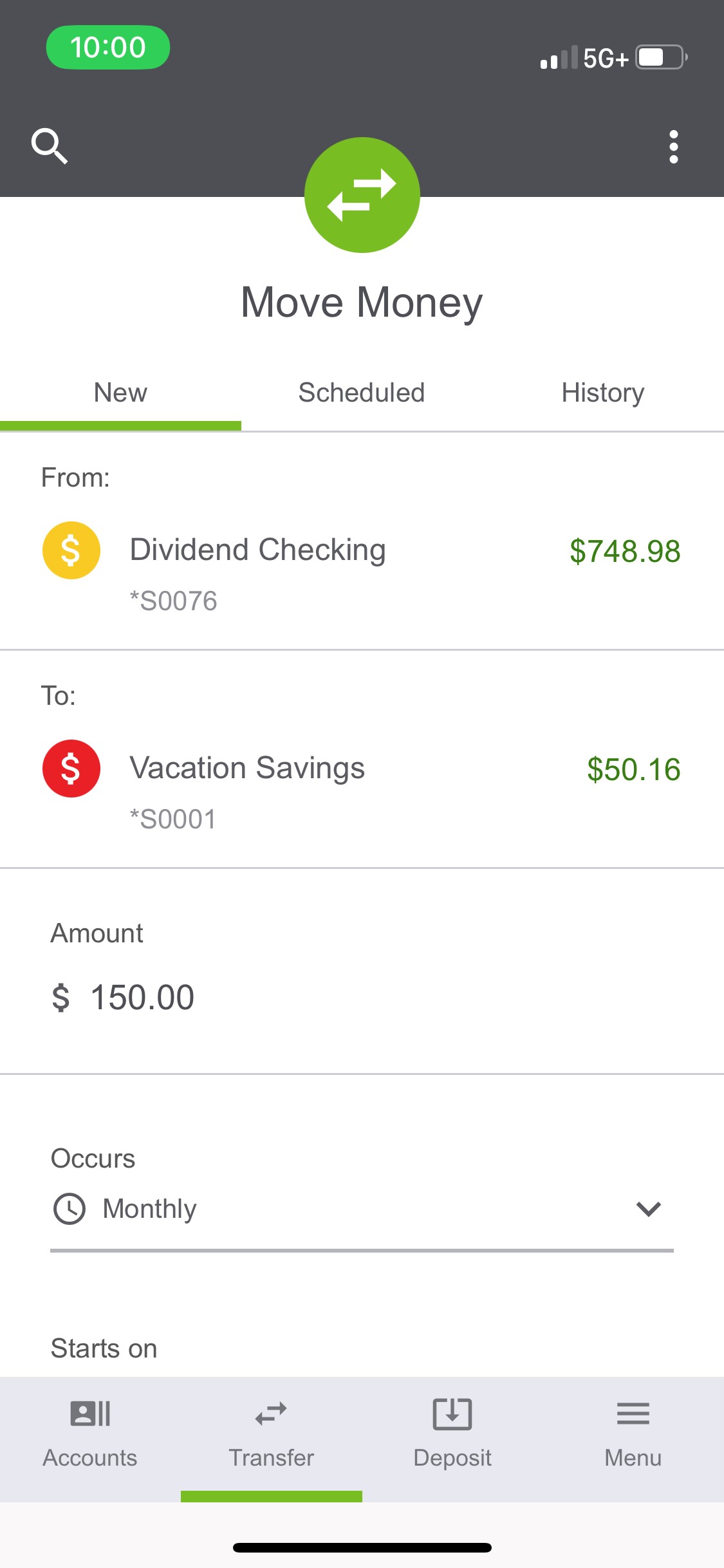

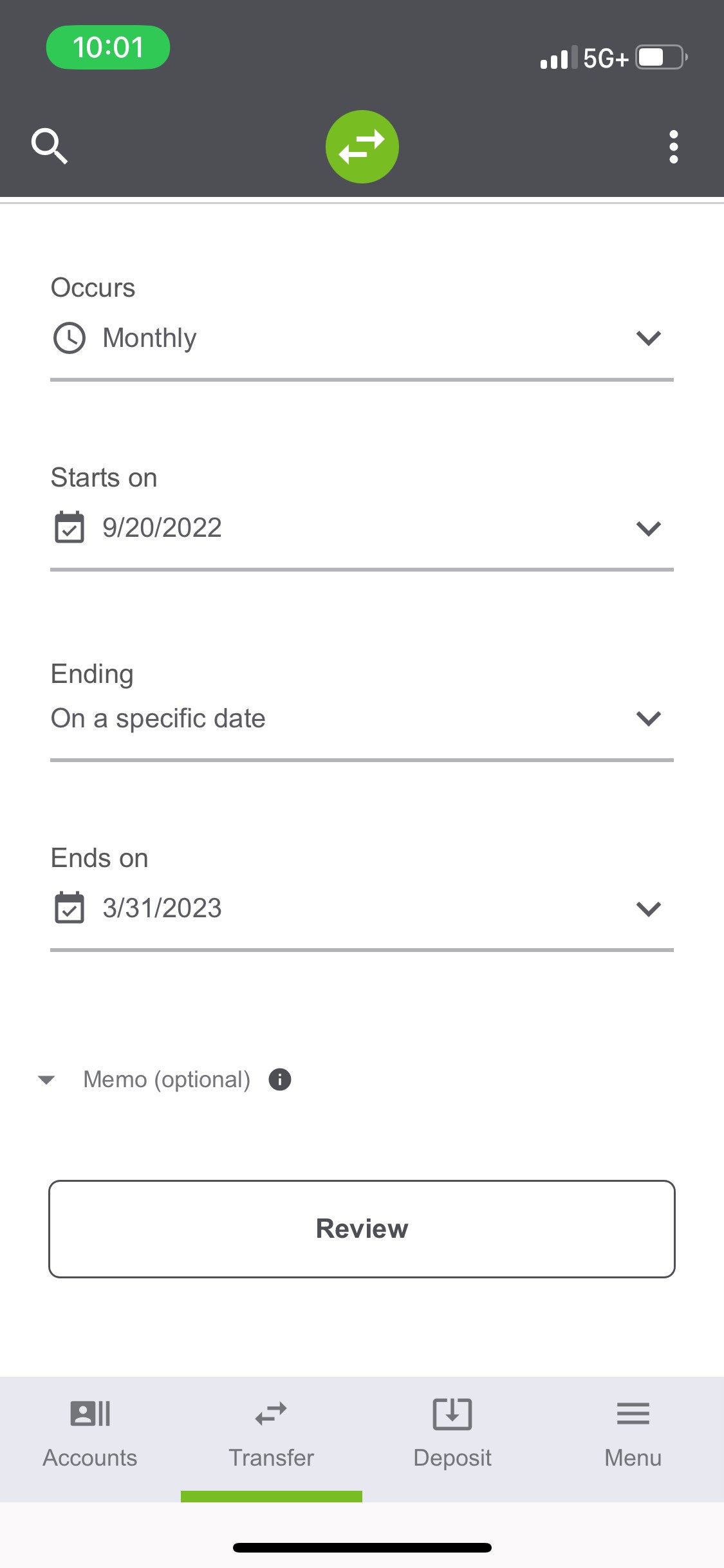

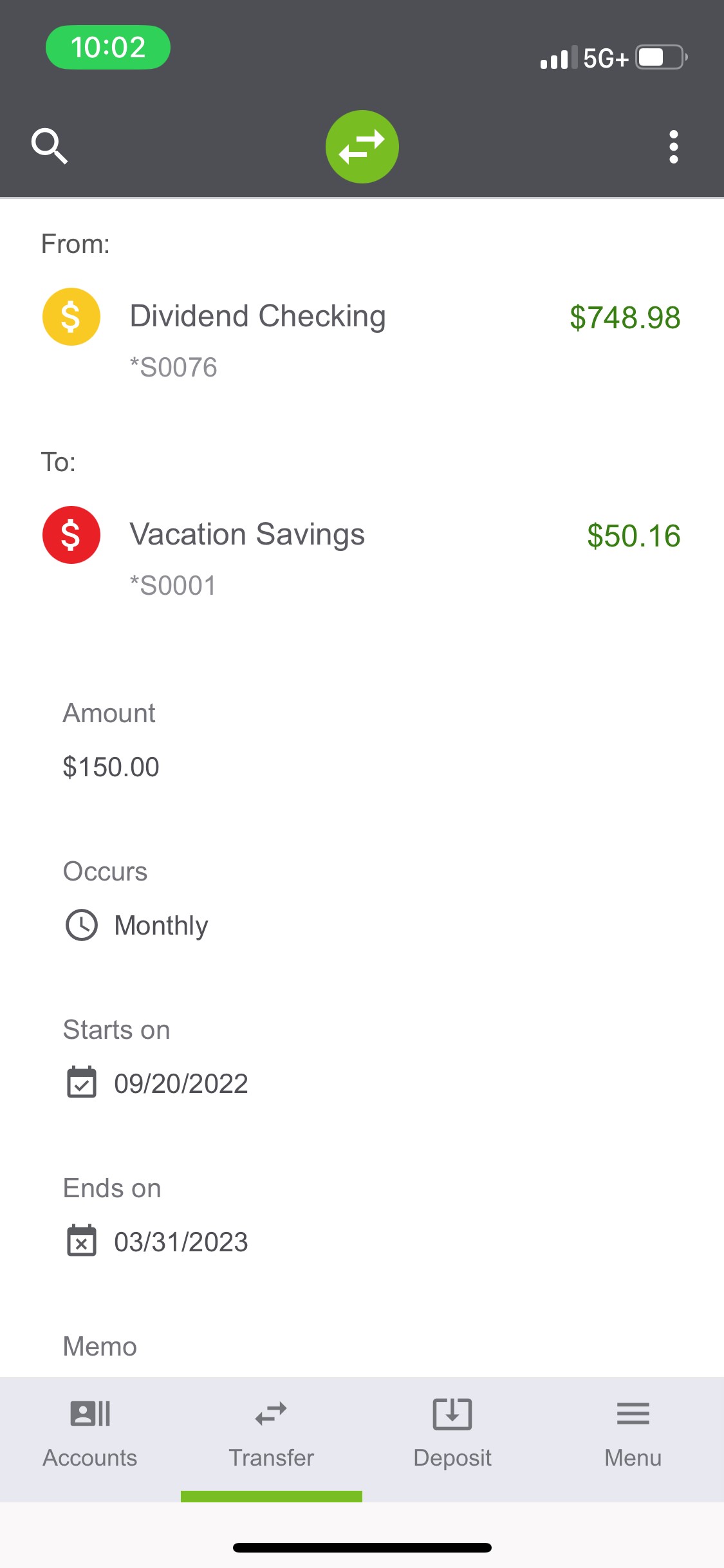

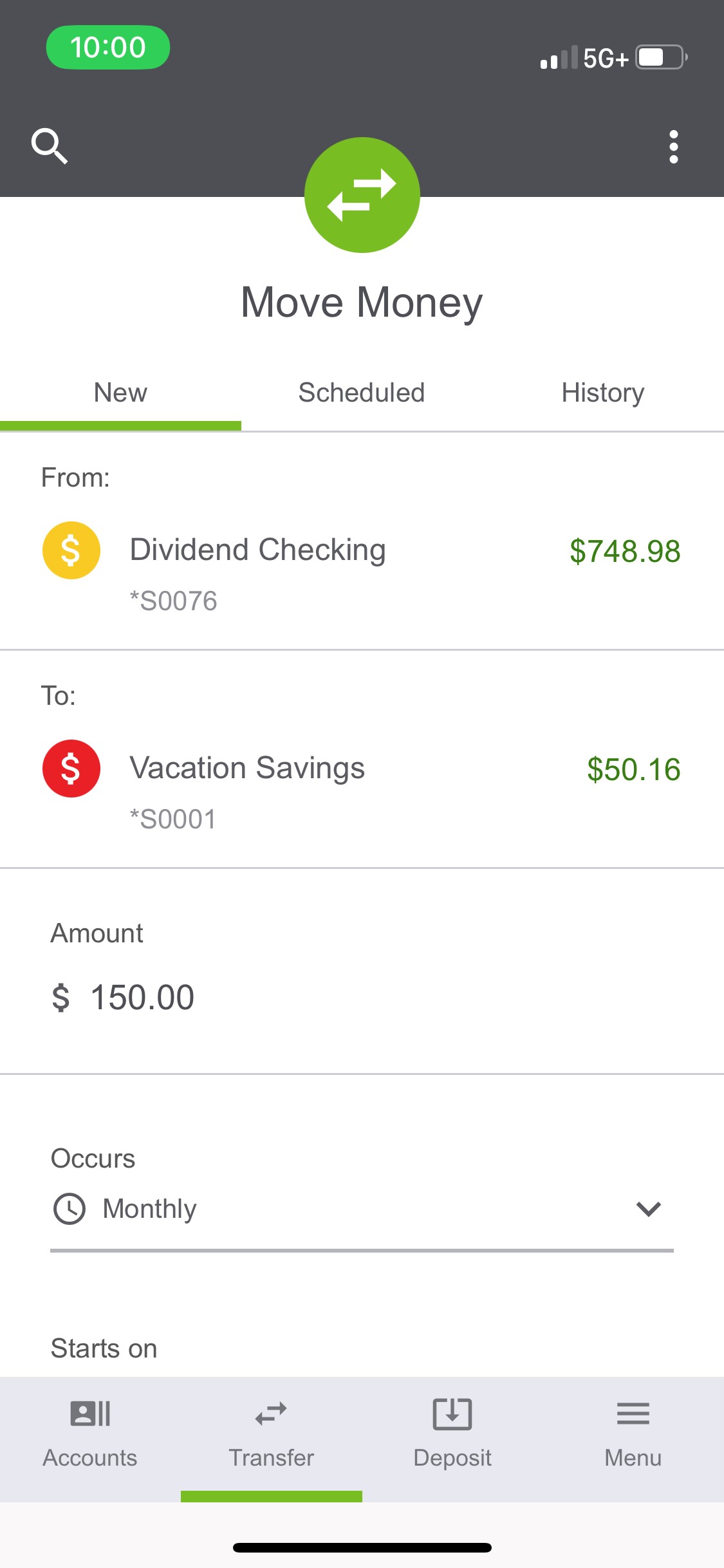

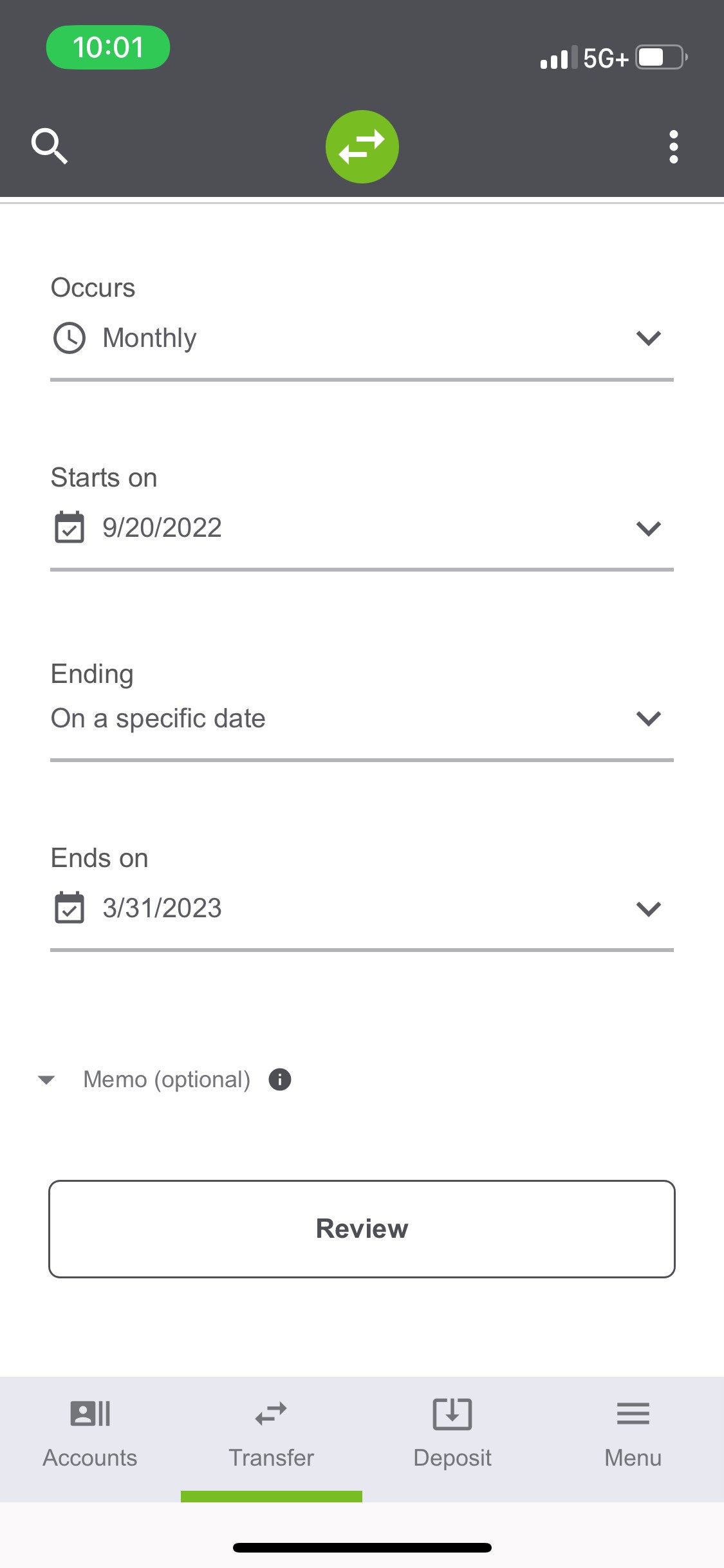

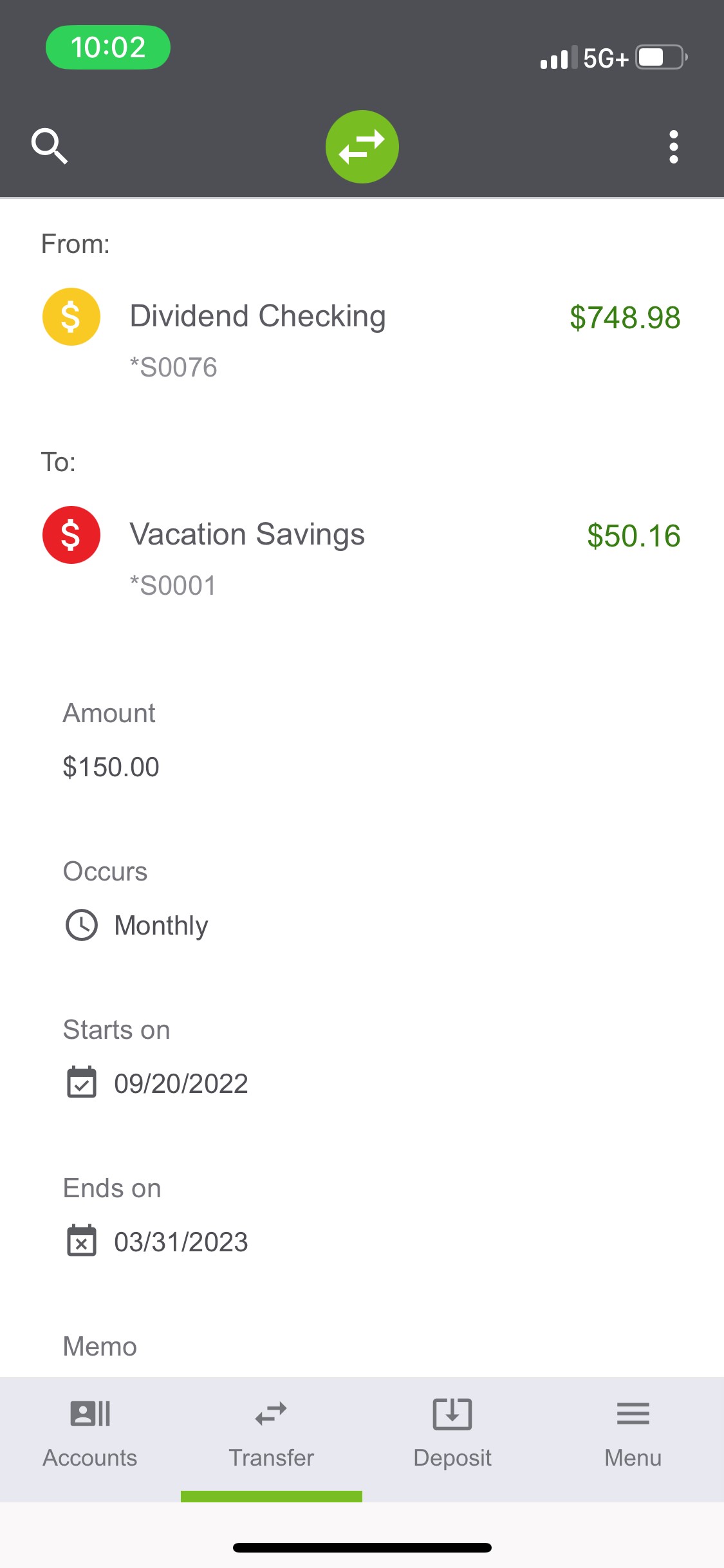

To set up automatic transfers between accounts, you can call our Member Service Center toll free at 800-688-7228 or visit any Credit Human location.

You can also set up automatic transfers in digital banking by setting your occurrence frequency to your preference. Recurring transfers can be modified or cancelled at any time from digital banking.

You can also set up automatic transfers in digital banking by setting your occurrence frequency to your preference. Recurring transfers can be modified or cancelled at any time from digital banking.

Early Pay is a benefit that comes with your Credit Human account in which we credit your eligible direct deposit up to two days early. The timing of when these transactions will be credited is based on when the payer submits the information to us. This means when these transactions are credited could vary and you may not receive your funds early.

Eligible transactions include any deposits, such as payroll, tax refunds, government benefits, military pay, state unemployment benefits, and pensions.

Already a member?

Take advantage of our streamlined application by logging into your account through digital banking. Once in digital banking choose Apply for a Loan. Members without digital banking access can apply using the non-member links below. In this process you will open an additional Credit Human membership account which requires a $5 minimum deposit.

Not yet a member?

Use the links below to complete the online loan application and apply for Credit Human membership during the process. Once a member, you'll become a part of a powerful financial cooperative with access to products designed with you in mind.

Credit Card Application

Home Loans Application

Personal Loan Application

Vehicle Loan Application

Take advantage of our streamlined application by logging into your account through digital banking. Once in digital banking choose Apply for a Loan. Members without digital banking access can apply using the non-member links below. In this process you will open an additional Credit Human membership account which requires a $5 minimum deposit.

Not yet a member?

Use the links below to complete the online loan application and apply for Credit Human membership during the process. Once a member, you'll become a part of a powerful financial cooperative with access to products designed with you in mind.

Credit Card Application

Home Loans Application

Personal Loan Application

Vehicle Loan Application

All deposits received by ACH or direct deposit are eligible for Early Pay. Direct Deposit and early payment of funds are subject to timing of payer information submission. Other deposits or credits to your account, such as deposits of funds from person-to-person payment services (e.g., Zelle®, Cash App, Venmo, or PayPal transfers), check or mobile deposits, and other online transfers may not be eligible for Early Pay.

To receive payments electronically, simply provide the Credit Human routing number 314088284 and your 14-digit checking account number to the organization that is paying you. They may require that you use a particular form (such as a direct deposit form) or they may ask you to provide a voided check. In some cases, you'll need to provide your account information online.

Learn More

Learn More

Use our convenient digital banking features to receive alerts when your account has been credited.

Early availability is not guaranteed and may vary from deposit to deposit, including those from the same payer. Early funds availability will depend on when we receive information from your payer, any limitations that we set on the amount of early availability, and the credit union’s standard fraud prevention screening.

There is no need to sign up. This service is automatic when you have a direct deposit to your Credit Human account.

Early Pay is free to all members.

Overdraft and Courtesy Pay

Courtesy Pay is another option for overdraft protection. Courtesy Pay is designed to help members when other alternatives have been exhausted. Learn more about overdraft protection options.

There is no cost if you do not use the service.

You should bring your checking account to a positive balance as soon as possible. If you are unable to immediately bring your checking account to a positive balance, you will receive notices from us informing you of the situation and your options. If your account is still negative after 44 days, your account will be closed and reported to a consumer reporting agency and further collection efforts may begin. If you are unable to pay the balance in full within 44 days and the negative balance was the result of Courtesy Pay, Credit Human may agree to set you up on an installment plan with up to four substantially equal monthly payments at a 0% Annual Percentage Rate.

No, overdraft coverage cannot be split. Overdraft coverage applies to the account, not to individual cards.

Savings accounts, public fund/charitable organization accounts, certain trust accounts, deceased member accounts, student minor accounts, and any other accounts for individuals under the age of 18 are not eligible for this service. We may, at our sole option and discretion, limit the number of your accounts eligible for Courtesy Pay to one account per household and/or one account per taxpayer identification number.

You may choose to opt-out of Courtesy Pay by visiting any Credit Human location or calling our Member Service Center 800-688-7228. Without Courtesy Pay, your insufficient funds items may be returned to the payee and/or declined at the point of purchase. You will still be charged the standard NSF/OD fee of $25.00.

In most instances, any item that exceeds the Courtesy Pay limit will be returned NSF/OD and the standard fee of $25.00 will be charged to your account.

Federal regulation requires that we obtain your prior authorization to pay these items. If you would like to provide authorization for us to pay these items, please visit any Credit Human location or call our Member Service Center at 800-688-7228.

Loans

Already a member?

Take advantage of our streamlined application by logging into your account through digital banking. Once in digital banking choose Apply for a Loan. Members without digital banking access can apply using the non-member links below. In this process you will open an additional Credit Human membership account which requires a $5 minimum deposit.

Not yet a member?

Use the links below to complete the online loan application and apply for Credit Human membership during the process. Once a member, you'll become a part of a powerful financial cooperative with access to products designed with you in mind.

Credit Card Application

Home Loans Application

Personal Loan Application

Vehicle Loan Application

Take advantage of our streamlined application by logging into your account through digital banking. Once in digital banking choose Apply for a Loan. Members without digital banking access can apply using the non-member links below. In this process you will open an additional Credit Human membership account which requires a $5 minimum deposit.

Not yet a member?

Use the links below to complete the online loan application and apply for Credit Human membership during the process. Once a member, you'll become a part of a powerful financial cooperative with access to products designed with you in mind.

Credit Card Application

Home Loans Application

Personal Loan Application

Vehicle Loan Application

Our loans offer competitive rates, which are subject to change without notice. You can find our current loan rates published online or by calling our Member Service Center toll free at 800-688-7228.

Published rate information is not a commitment to make a loan, nor is it a guarantee that you will receive a specific rate if approved. Factors that may affect loan rates may include, but are not limited to, your credit rating, the loan amount and term, or other factors specific to the type of loan you are pursuing.

Published rate information is not a commitment to make a loan, nor is it a guarantee that you will receive a specific rate if approved. Factors that may affect loan rates may include, but are not limited to, your credit rating, the loan amount and term, or other factors specific to the type of loan you are pursuing.

Learn various ways you can make a payment on your loan by visiting the Ways to Pay page. For instructions on how to use our digital banking platform to make a payment, visit our video tutorial page.

If you have a loan with Credit Human, or need help with loan questions, please call our loan specialists, available Monday - Friday 7 a.m. to 7 p.m., or Saturday 9 a.m. to 3 p.m. If you need to report a servicing issue, to file a complaint, or get more information regarding a Credit Human loan, contact us by mail or email.

Loan Inquiries by Phone

Toll Free: 800-667-7228

Loan Inquiries by Email:

[email protected]

Loan Inquiries by Mail:

Attention: Loan Services

Credit Human P.O. Box 1356

San Antonio, TX 78295-1356

Loan Inquiries by Phone

Toll Free: 800-667-7228

Loan Inquiries by Email:

[email protected]

Loan Inquiries by Mail:

Attention: Loan Services

Credit Human P.O. Box 1356

San Antonio, TX 78295-1356

Credit Human offers a range of solutions to help members during difficult times like this, particularly when you are faced with periods of reduced or lost income. Whether your personal situation calls for delaying a payment, increasing your credit line, waiving a fee or getting a loan, our team is here for you. To request a loan extension on a Credit Human loan please use our Loan Extension Request form.

Skipping a payment without incurring a fee is available in digital banking for Signature and vehicle loans. Log into digital banking and select Skip-A-Pay from the menu options.

Skipping a payment without incurring a fee is available in digital banking for Signature and vehicle loans. Log into digital banking and select Skip-A-Pay from the menu options.

You can make the final payment of your loan online or by calling our Member Service Center at 800-688-7228.

To make your payment online, log into digital banking and choose Payoff amount when making a payment.

For additional ways to make your final payment visit CreditHuman.com/Pay.

To make your payment online, log into digital banking and choose Payoff amount when making a payment.

For additional ways to make your final payment visit CreditHuman.com/Pay.

QMoney Loans

QMoney is a short term loan that does not require a credit check. Eligibility for the loan is based on your Credit Human membership.

You are eligible if you have been a member with an open deposit account for 6 months or more, made deposits totaling $800 or more within the last 61 days, are at least 18 years of age, are the primary account holder and are in good standing with the credit union. In order to be considered a member in good standing with Credit Human you must not have overdrawn accounts, loans past due or charged off loans (credit cards included).

You may apply for a QMoney loan in digital banking.

You can borrow between $200 and $500. Your borrowing limit is calculated based on the total eligible deposits made to your primary Credit Human account(s) within the past 60 days.

If your QMoney loan is between $200 and $500 you will have 60 days to repay the loan in two equal payments.

Members who are active military and their dependents are not eligible for a QMoney loan due to the Military Lending Act regulation administered by the Department of Defense.

The annual percentage rate for the QMoney loan is 28%.

Yes, there is a $20 non-refundable application fee. This fee is charged to all applicants regardless of the loan decision. A late fee will be assessed if your payment is 10 or more days past due. The late fee is equal to 5% of the unpaid scheduled payment.

Fees are automatically deducted from the oldest open checking account. If there is no checking account available the funds will be drawn from the oldest open share savings account.

Fees are automatically deducted from the oldest open checking account. If there is no checking account available the funds will be drawn from the oldest open share savings account.

You can only have one QMoney loan at a time, with no more than three QMoney loans within a six-month rolling period.